Donate Securities

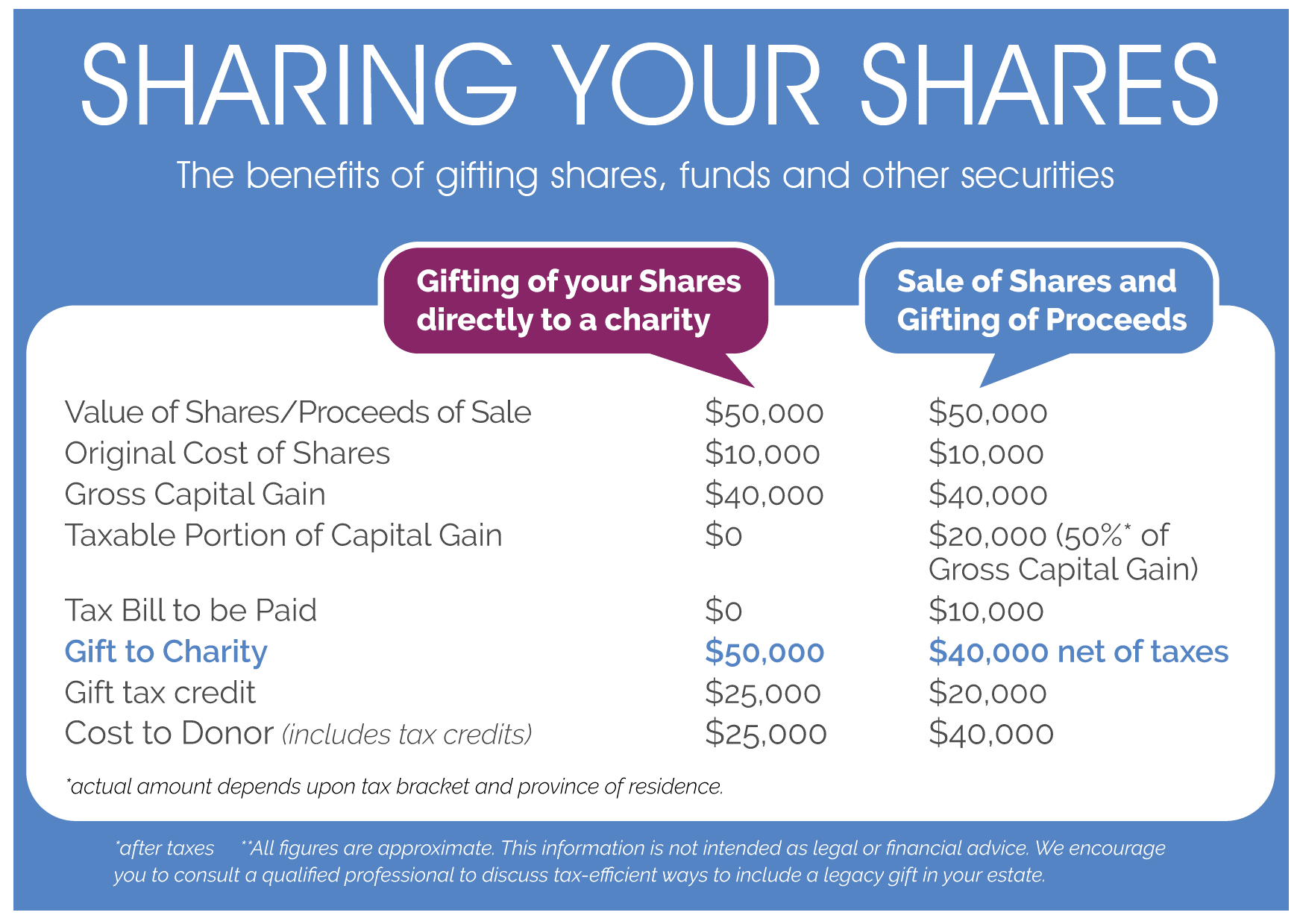

Donating stocks, bonds, mutual funds or other securities is a tax-smart way to support the work of Birchway Niagara. By donating securities directly to a charity, you avoid the capital gains tax involved in selling your stock.

How to make your donation of securities

It is easy to donate securities by having them transferred directly from your account to Birchway Niagara. You will receive a tax receipt for the full market (resale) value of your securities at the time they are transferred. Your gift will result in a non-refundable tax credit that will reduce your income taxes. You can use it in the year of your gift or carry it forward for up to five additional years.

To get started, download our securities donation form by clicking here and share it with your financial advisor. To notify us of your gift, or if you have any questions, contact Birchway Niagara’s Director of Development and Stewardship, Amanda Braet at 905-356-3933 ext. 240 or amandab@birchway.ca